2018 Recap and 2019 Look Ahead – TSCA Emerging as a Major U.S. Environmental Law

2018 was a very active year for EPA’s Toxic Substances Control Act (TSCA) program. In 2016, Congress set aggressive deadlines for the Environmental Protection Agency (EPA) to implement the 2016 Frank R. Lautenberg Chemical Safety for the 21st Century Act, which significantly overhauled TSCA. Most impressively, EPA met most of its 2017 and 2018 deadlines—an achievement for an agency burdened with such an enormous undertaking. The major exception lies with the new chemical premanufacture review program, where the required 90-day processing timeframe remains an elusive target, with many reviews extending beyond a year.

It is rare for Congress to significantly upend an existing federal environmental statute, as they did with TSCA. The TSCA program is fundamentally changing, and the impacts will extend well beyond TSCA’s traditional boundaries. The amount of regulation and case law that are being generated today, and will be generated over the next decade, has the potential to make TSCA a priority for in-house counsel and regulatory professionals on par with better known counterparts like the Clean Air Act and Superfund. To help industry specialists keep track of the voluminous developments that are ongoing in the TSCA program, this article reviews the top ten achievements of EPA’s 2018 TSCA program, the key pending cases, Congressional activity, and provides a preview of what to expect in 2019.

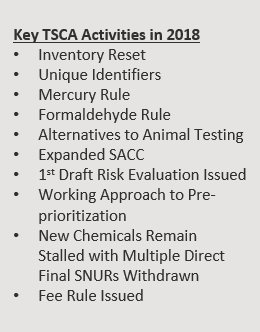

2018 TSCA Countdown – An Active Year for EPA on the TSCA Front

In 2018, industry reported to EPA on which chemicals on the TSCA Inventory are actively manufactured, imported, and processed in commerce. EPA issued a strategic plan to identify and achieve greater reliance on alternatives to animal testing, and the agency finalized new and expanded fees for the premanufacture assessment of new substances and the evaluation and testing of existing chemicals. These are among the following top 10 actions EPA took to implement new TSCA in 2018.

Number 10. Inventory Reset – February 7, 2018, marked the deadline for mandatory submission of a Notice of Activity (NOA) Form A by manufacturers and importers for chemicals that were commercially active in the 10 years prior to June 22, 2016. Processors had until October 5, 2018 to voluntarily submit these reports. For 90 days after EPA issues the updated TSCA Inventory in early 2019, companies will still be able to notify EPA of Inventory-listed chemicals that they commercialized for the first time after June 22, 2016. Thereafter, companies will need to file an NOA Form B before they manufacture, import or process an inactive substance on the Inventory. The upshot of this exercise is that by early in 2019, it will finally be clear how many chemicals are in active use in commerce today, and this might help EPA prioritize the mandatory review of those active chemicals on the TSCA Inventory. 82 Fed. Reg. 37520 (Aug. 17, 2017), codified at 40 C.F.R. Part 710.

Number 9. Unique Identifiers for Confidential Chemicals – Section 14(g)(4) of TSCA requires EPA to assign a unique identifier to each substance listed on the TSCA Inventory for which EPA approves a confidential business information (CBI) claim for the chemical identity. The unique identifier will be used to link documents that relate to the confidential substance. After issuing several proposals for public comment, EPA issued its final plan on June 27, 2018. 83 Fed. Reg. 30168 (June 27, 2018). The policy describes the controls EPA will apply so that grouping information in this manner does not inadvertently disclose the CBI substance identity. The system bears watching for clashes between “right-to-know” information disclosure and the rights of industry to maintain the confidentiality of proprietary information.

Number 8. Mercury Inventory Rule – The Lautenberg Act breathed new life into longstanding government efforts to lower exposures to mercury. Congress called on EPA to finalize a rule by June 2018 to require companies to report the manufacture or import of mercury and mercury compounds. The reports will be used to prepare an Inventory of mercury supply, use, and trade in the United States that is expected in 2020. 83 Fed. Reg. 30054 (June 27, 2018). These reports should disclose commercial activities from January 1, 2018, to December 31, 2018, and the deadline for submission is July 1, 2019. The Natural Resources Defense Council (NRDC) has petitioned the U.S. Court of Appeals for the 2nd Circuit to review certain parts of the rule, including a provision that allows companies to import final products with a mercury containing component without having to submit a report. On October 15, 2018, the court consolidated NRDC’s case with a challenge to the same rule brought by the state of Vermont, Vermont v. EPA, No. 18-2670 (2d Cir. filed Sept. 10, 2018). In December, a coalition of 10 states filed an amicus brief in support of Vermont’s challenge of the rule.

Number 7. Formaldehyde Rule – The Formaldehyde Emission Standards for Composite Wood Products Act pre-dated the Lautenberg Act by six years. It added Title VI to TSCA in 2010 and called for EPA to establish a formaldehyde emission standard and a third-party certification system for composite wood products. EPA implementation of these requirements has been controversial, but finally began to emerge in 2018. As of June 1, 2018, regulated composite wood, component parts, and finished goods containing them that are manufactured or imported must be certified as compliant. Separately, after March 22, 2019, new import certification requirements go into effect. U.S. Customs and Border Protection (CBP) will require regulated composite wood products that are imported into the U.S. to be certified as TSCA Title VI compliant. Certifying to California’s standard, which has been an option for companies up until now, will be insufficient. On December 11, 2018, CBP announced the new certification requirements for importing regulated composite wood products in Cargo Systems Messaging Service (CSMS) #18-000727. The import certification is in addition to and different than the one that importers already are required to provide under TSCA Section 13. Companies will be required, if EPA requests, to submit documentation that demonstrates compliance. A link to the underlying 2016 rule is available here: https://www.epa.gov/formaldehyde.

Number 7. Formaldehyde Rule – The Formaldehyde Emission Standards for Composite Wood Products Act pre-dated the Lautenberg Act by six years. It added Title VI to TSCA in 2010 and called for EPA to establish a formaldehyde emission standard and a third-party certification system for composite wood products. EPA implementation of these requirements has been controversial, but finally began to emerge in 2018. As of June 1, 2018, regulated composite wood, component parts, and finished goods containing them that are manufactured or imported must be certified as compliant. Separately, after March 22, 2019, new import certification requirements go into effect. U.S. Customs and Border Protection (CBP) will require regulated composite wood products that are imported into the U.S. to be certified as TSCA Title VI compliant. Certifying to California’s standard, which has been an option for companies up until now, will be insufficient. On December 11, 2018, CBP announced the new certification requirements for importing regulated composite wood products in Cargo Systems Messaging Service (CSMS) #18-000727. The import certification is in addition to and different than the one that importers already are required to provide under TSCA Section 13. Companies will be required, if EPA requests, to submit documentation that demonstrates compliance. A link to the underlying 2016 rule is available here: https://www.epa.gov/formaldehyde.

Number 6. Strategic Plan for Developing Alternative Test Methods – As required by section 4(h)(2)(A) of the Act, EPA issued a “Strategic Plan to Promote the Development and Implementation of Alternative Test Methods within the TSCA Program” in June 2018 (available at https://www.epa.gov/sites/production/files/2018-06/documents/epa_alt_strat_plan_6-20-18_clean_final.pdf). The report sets goals in the next 5 years and beyond for adopting “new approach methodologies” (NAMs), that offer alternative test methods or strategies to reduce or replace vertebrate animal testing. It will take several years to validate and rely on alternatives to well-established animal models. This is an area that is bound to generate tension in the meantime as EPA seeks to fulfill the competing mandates of reducing animal testing while gathering more information to assess the hazards associated with chemicals on the TSCA Inventory.

Number 5. Science Advisory Committee on Chemicals (SACC) – EPA plans to have each and every risk evaluation it completes for an existing chemical to be peer-reviewed by experts from the SACC. 83 Fed. Reg, 61629 (Nov. 30, 2018). Since peer review of every risk evaluation is not mandated by TSCA, this choice by the agency potentially signals that a key role for members of this committee will be to help EPA uphold the new sound science provisions in TSCA. Section 26(o) of TSCA requires EPA to select these third party experts to advise the agency on scientific and technical aspects of TSCA implementation. Therefore, another key role for this group, similar to what EPA has done under the pesticide program, would be to convene on critical science issues, such as aggregate risk assessment methodologies. In 2018, EPA made strides to grow the pool of experts it will tap into starting in 2019. In March, EPA selected eight additional SACC members and issued nominations for several more. 83 Fed. Reg. 46487 (Sept. 13, 2018), 83 Fed. Reg. 64341 (Dec. 14, 2018). The agency has included a charge question about its systematic review approach for evaluating existing chemicals in its list of charge questions to the SACC when it peer reviews the first draft assessment OPPT has produced for pigment violet 29.

Number 4. 1st Draft Risk Evaluation Issued – In November 2018, EPA published a notice seeking public comment on the first draft chemical risk evaluation under TSCA for pigment violet 29 (PV29). 83 Fed. Reg. 57473 (Nov. 15, 2018). Although this chemical made it onto EPA’s 2014 Work Plan as a priority for review, EPA has proposed a no unreasonable risk finding based on the limited use pattern and anticipated low exposure. Environmental groups have filed a Freedom of Information Act (FOIA) request to force the release of studies that EPA relied on which the agency has deemed as confidential business information (CBI). TSCA gives EPA 3.5 years to complete these risk evaluations, so expect to see more risk evaluation decisions soon for the rest of the “initial” 10 in 2019.

Number 3. Working Approach on Pre-Prioritization – In October, EPA released a “working approach” for identifying potential candidates that it plans to consider for selecting existing chemicals for prioritization and risk evaluation. 83 Fed. Reg. 50366 (Oct. 5, 2018); “A Working Approach for Identifying Potential Candidate Chemicals for Prioritization”. This was the agency’s third attempt to transparently describe how it will select chemicals from the Inventory to ramp up the program that was widely viewed as the hallmark of the 2016 overhaul. EPA has now issued two guidance documents for public comment, following the agency’s withdrawal of proposed provisions addressing this aspect of the process in the final prioritization rule. In the immediate future, the selection process will be largely guided by the 2014 Work Plan list, existing agency resources, and overarching agency priorities. Despite the fact that this part of the process will lay the groundwork for years of work, the steps and timing are vague.

Number 2. PMN Reviews and Multiple Direct Final SNURs Withdrawn – The challenges associated with navigating TSCA’s new chemical review program put it near the top in terms of significance. Compared to a historical average of 50 – 60 withdrawn submissions each year, EPA has ruled 141 submissions incomplete and an additional 220 submissions have been pulled from review by submitters in the last two years alone. https://www.epa.gov/reviewing-new-chemicals-under-toxic-substances-control-act-tsca/statistics-new-chemicals-review. While EPA considers 300 pending cases the norm, at the end of 2018 there were 553 pending new chemical cases. One statistic that EPA does not track publicly is the time that these reviews are taking. Few are finished within the statutorily mandated 90-day period and many are taking well over a year and most submissions are now regulated through consent orders. EPA proposed 342 Significant New User Rules (SNURs) in the latter part of the year to level the commercial and regulatory playing field, since consent orders only bind the companies that sign them and a substance on the Inventory can be manufactured by anyone. The agency has tried to expedite these actions by issuing direct final SNURs, which take effect in 60 days if no objections are raised. However numerous public comments were received, including some by the environmental groups that question if it is appropriate for EPA to modify consent order conditions in a SNUR. Given the significance of this program to supporting US innovation, the agency needs to devote continued attention to restoring this program to routine operation. https://www.epa.gov/reviewing-new-chemicals-under-toxic-substances-control-act-tsca/statistics-new-chemicals-review .

Number 1. Fee Rule Issued – Of all the changes to TSCA, section 26(b) of TSCA will have the most significant long-term impact in terms of cost to US industry. Congress is requiring that TSCA user fees cover at least 25% of implementation of the Act or $25,000,000, whichever is lower. EPA issued a final fee rule on October 17, 2018 that significantly expands the amount and types of fees, with lower fees for small businesses. 83 Fed. Reg. 52694 (Oct. 17, 2018). Multi-million dollar fees from chemical manufacturers will be required for EPA to conduct risk evaluations of existing chemicals. Fees will be imposed to have EPA review test data, and new chemical evaluation fees have jumped from $2,500 to $16,000 per chemical. The fees apply to submissions made from October 1, 2018 onward.

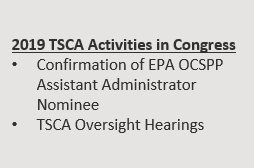

Congress and TSCA

For the last two years EPA has been without an Assistant Administrator (AA) for its Office of Chemical Safety and Pollution Prevention (OCSPP), the office that oversees TSCA and FIFRA.  President Trump’s first nominee was rejected by the Senate for his close ties to industry. Trump’s 2nd nominee for the AA position, Alexandra Dunn, was confirmed by the Senate on January 2, 2019 -- the last day of the 115th Congress. Ms. Dunn is considered by both parties to be well-qualified with a balanced background. Prior to her confirmation as Assistant Administrator, she served as Regional Administrator for EPA’s Region 1 office in Boston and before that, as executive director and general counsel for the Environmental Council of the States (ECOS).

President Trump’s first nominee was rejected by the Senate for his close ties to industry. Trump’s 2nd nominee for the AA position, Alexandra Dunn, was confirmed by the Senate on January 2, 2019 -- the last day of the 115th Congress. Ms. Dunn is considered by both parties to be well-qualified with a balanced background. Prior to her confirmation as Assistant Administrator, she served as Regional Administrator for EPA’s Region 1 office in Boston and before that, as executive director and general counsel for the Environmental Council of the States (ECOS).

In the House, newly controlled by the Democrats, there is an expectation that TSCA oversight hearings will be held in the coming year to evaluate EPA’s implementation of the 2016 TSCA amendments. Rep. Paul Tonko (D-NY) is expected to chair the responsible House subcommittee and is among those calling for the oversight hearings. With oversight hearings, the amended TSCA will have gone full circle – from Congress to EPA and back again.

Legal Challenges to EPA’s TSCA Implementation

2018 saw one of the three challenges to TSCA’s new framework defeated in the 2nd Circuit Court of Appeals, with two actions still pending before the D.C. and 9th Circuits. Natural Resources Defense Council v. EPA, No. 18-25 (2d Cir. filed Jan. 5, 2018) sought review of EPA’s “New Chemicals Decision-Making Framework: Working Approach to Making Determinations under Section 5 of TSCA.” NRDC took issue with EPA’s interpretation of its authority to regulate new chemicals through a SNUR rulemaking without first issuing a consent order. Based on EPA’s assertion that it has not yet followed the SNUR approach described in the Framework, the court dismissed the suit. Several weeks later, EPA proposed non-order SNURs for new chemicals with pending PMNs, which includes a preamble discussion of issues that were the subject of the litigation.

The ability of follow-on companies to reassert a CBI claim originally made by another company to keep a chemical identity confidential on the TSCA Inventory listing is the central issue in the challenge pending in the Court of Appeals for the District of Columbia Circuit, Environmental Defense Fund v. EPA, No. 17-1201 (D.C. Cir. filed Sept. 1, 2017). The case has been on-going as EPA has been implementing the Inventory Reset Rule. Oral arguments were heard on October 12, 2018, and a decision is expected in the coming new year.

The litigation over EPA’s prioritization and risk evaluation rules primarily surrounds the proper interpretation of the new “conditions of use” language under TSCA and is being heard by the U.S. Court of Appeals for the Ninth Circuit. Safer Chemicals, Healthy Families v. EPA, No. 17-72260 (filed Aug. 11, 2017). The court recently granted a partial remand to EPA of a penalty provision associated with the failure to provide complete information to EPA. Remand decisions are pending on two other parts of the rule.

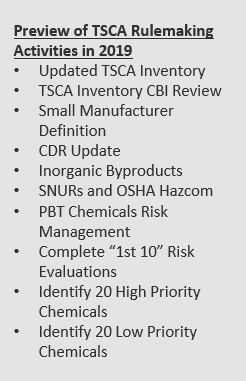

2019 Slated to be Just as Active, With Focus on Existing Chemicals and New Chemical Program Stability

In 2019, TSCA will stay a busy federal program. Shortly after the new year, the agency will release the updated TSCA Inventory with active and inactive substance designations. It is anticipated that slightly more than half of the 80,000 chemicals listed on the Inventory will be designated as active in commerce, based on the reports submitted under the Inventory Reset Rule. This year, EPA needs to move forward and propose requirements for reviewing CBI claims and substantiating CBI claims for chemical identity. The agency also plans to update the size standard for defining a small manufacturer for TSCA purposes.

It is anticipated that slightly more than half of the 80,000 chemicals listed on the Inventory will be designated as active in commerce, based on the reports submitted under the Inventory Reset Rule. This year, EPA needs to move forward and propose requirements for reviewing CBI claims and substantiating CBI claims for chemical identity. The agency also plans to update the size standard for defining a small manufacturer for TSCA purposes.

In addition, EPA is slated to update the Chemical Data Reporting (CDR) rule where it may once again take up the controversial topic of reporting inorganic byproducts. In the coming year, the agency is expected to finalize the July 28, 2016 proposed rule to align TSCA SNUR provisions with the 2012 OSHA Hazard Communication Standard and continued administrative changes to improve the timing and predictability of new chemical reviews can be expected. Beyond this, EPA has to develop a proposed rule in 2019 under TSCA section 6(h) to regulate certain persistent, bioaccumulative, and toxic (PBT) chemicals on the 2014 Work Plan. However, the bulk of agency activity in 2019 will be devoted to completing the remainder of the first 10 risk evaluations and to designating 20 high priority substances for risk evaluation, as well as 20 low priority substances. The prioritized substances need to be announced by March 2019 for EPA to continue to meet TSCA’s strict deadlines. In 2019, we may see the first industry-sponsored requests for voluntary risk evaluations for certain existing chemicals as well.

Our Recommendations for the Supply Chain if Your Products are Affected by TSCA

As 2019 begins, there are several take-aways for in-house counsel and regulatory managers in light of the developments we expect to see in the coming months. First, TSCA is no longer the primary domain of the chemical raw material manufacturer and importer. EPA now also must take into consideration how raw materials are handled and used all the way downstream to the consumer. Because TSCA requires EPA to look at substances that have been in commercial use for many years, intermediate and final products face the potential for new and more regulation from TSCA, including “articles”, which may no longer be presumed safe. The new TSCA in sections 5 (new chemicals) as well as sections 6 (existing chemicals) specifically calls on EPA to look at uses of chemicals in articles. EPA is directed by section 6(c) to take certain regulatory actions with respect to chemicals in articles and mixtures “only to the extent necessary” to ensure that the use does not present an unreasonable risk of injury to health or the environment.

Second, it is critical to understand that your company could be vulnerable to regulation under TSCA based on the potential for exposure to the chemicals in your products under the conditions that they are used, in the workplace and beyond. EPA relies heavily on modeling. This can work in a company’s favor if a worst-case modeling scenario does not raise a safety concern, because other uses with less exposure to the chemical also will be acceptable. However, if EPA doesn’t have good information on how chemicals are used, they will default to conservative modeling estimates and potentially overestimate risk. There is a reasonably high likelihood that your company will encounter TSCA regulations that stem from incomplete exposure information. In most cases actual data on exposure to existing chemicals is currently either not available or non-existent. TSCA’s historic focus is on identifying chemical hazards, and the agency is rather good at it. EPA has more limited information and experience with the methods industry uses to control workplace and consumer exposures.

Third, companies with products that interface directly with consumers need both a strategy and a process to identify and manage the business disruption that TSCA may cause. To understand if your company will be immediately vulnerable we recommend mapping the EPA’s 2014 Workplan list of chemicals against your list of raw materials. These are the chemicals that EPA is most likely to review first. Ultimately, however, EPA says in its “working approach” policy paper that it is planning to consider for prioritization and possible risk evaluation all of the active chemicals on the TSCA Inventory, and the agency can review a chemical that is not on the 2014 Work Plan sooner should the need arise. Engage with suppliers to identify alternative feedstocks just as you would seek to have alternative sources of supply.

Fourth, with respect to your company’s plans for innovation, bear in mind that new chemical reviews may extend for a year or more, impacting commercialization schedules and contracts. Bear in mind that insufficient information alone provides EPA with a sufficient legal basis to regulate. Unless extended timeframes and contingencies for unforeseen regulatory needs are built into cooperative supply agreements, transaction disputes will mount from delays and unexpected regulation related to PMN filings and consent order negotiations.

Fifth and finally, given the tight deadlines EPA is under to review existing chemicals, the timing of prioritization and risk assessment may limit EPA’s ability to mandate or collect new data needed to ensure a fair scientific and legal review. Organizing downstream industry groups into consortia is often an effective way to develop needed information and effectively negotiate favorable terms on behalf of your industry. The cost of collecting chemical-specific use and exposure data, which can be significant, can be shared by all participants. Consortia provide companies with the opportunity to speak with one voice to EPA policymakers, and more efficiently and effectively comment on draft risk evaluations and proposed risk management actions. It is relatively easy to set up and manage consortia or an industry task force for this purpose, which is usually done by agreement with participants contributing funds to support data collection/generation. Cost sharing can be on a per capita basis or utilize other formulas (i.e., market share or position in supply chain). The administrative functions can be managed by outside third parties or via a governing body of the consortia. It’s been our experience that consortia have been used very successfully to collect exposure and use data and manage data compensation with respect to pesticides, and we think forming groups to address downstream exposures to chemicals will prove equally useful under TSCA.